The Macro Landscape: What’s Driving Market Conditions?

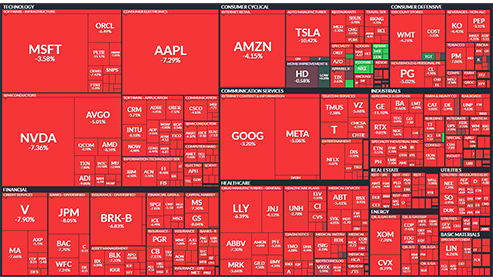

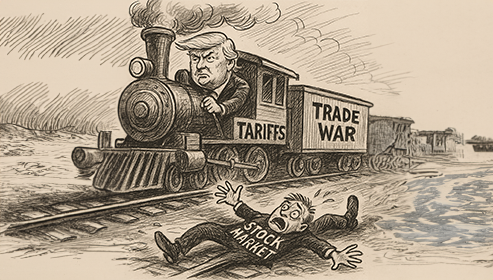

On March 10, 2025, U.S. stock markets experienced significant declines, primarily due to escalating trade tensions and rising fears of an economic slowdown. President Donald Trump's recent comments, where he declined to rule out the possibility of a recession, have further unsettled investors. The implementation of new tariffs on imports from Canada and Mexico has exacerbated concerns about global trade relations and their impact on economic growth.

Zooming In: How This Impacts the Technology Sector

The technology sector, often considered the backbone of U.S. economic growth, has been particularly vulnerable. Companies like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), NVIDIA (NVDA), and Tesla (TSLA) have experienced substantial stock price declines. These companies, collectively known as the "Magnificent Seven," are heavily reliant on global supply chains and international markets, making them sensitive to trade disruptions. (reuters.com)

Key Risks & Opportunities for Traders

Risks:

-

Continued Volatility: Ongoing trade disputes and policy uncertainties may lead to sustained market volatility.

-

Economic Slowdown: Prolonged trade tensions could dampen consumer confidence and corporate investments, potentially leading to a broader economic downturn.

Opportunities:

-

Selective Buying: Investors with a long-term perspective might consider accumulating shares of fundamentally strong tech companies at discounted prices.

-

Hedging Strategies: Utilizing options to hedge against further declines can protect portfolios during uncertain times.

Trading Strategies: How to Play This Thesis

-

Dollar-Cost Averaging (DCA): Investors can mitigate timing risks by systematically investing fixed amounts in tech stocks over regular intervals, thereby averaging out the purchase price over time.

-

Protective Puts: Purchasing put options on major tech holdings can serve as insurance against further declines, limiting potential losses while maintaining upside potential.

-

Sector Rotation: Shifting investments from high-growth tech stocks to more defensive sectors, such as utilities or consumer staples, can reduce exposure to volatility associated with trade tensions.

The Trader’s Take

As a macro-focused trader, I recognize that the current market dynamics are heavily influenced by geopolitical events and policy decisions. While the technology sector faces headwinds due to its global exposure, these challenges may present buying opportunities for investors with a long-term horizon. However, caution is warranted, and employing risk management strategies, such as hedging and diversification, is advisable. Monitoring developments in trade negotiations and economic indicators will be crucial in navigating the markets in the coming months.

AAPL MSFT AMZN GOOGL META NVDA TSLA